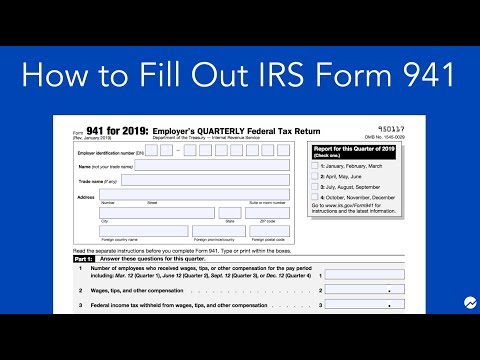

P>Hi everyone I'm Priyanka Prakash senior staff writer at fender ah today I'll show you how to fill out I RS form 941 form 941 is a form the businesses file quarterly to report without income taxes from their employees wages as well as the employer and employees share of Social Security and Medicare taxes which are together called FICA taxes in general if you'll be paying wages of more than $4,000 per year giving you a tax liability of more than one thousand dollars per year then you'll need to submit form 941 on a quarterly basis let's get started with the form to begin indicate the quarter for which you're filling the form out form 941 is due on the last day of the quarter following the period for which you're filing for example you'd file the form by April 30th to cover wages paid in January February and March the other deadlines are July 31st October 31st in January 31st in this case I'm going to choose option 1 I'm filing by April 30th to cover wages paid in January February and March then you'll type in or write in if your hand filling the form your business's in number name and address I'm going to pr this information for a sample business since this is an us-based business I'm going to leave the bottom three boxes there blank okay moving on to part 1 which is the most important part of the form because this is where you'll be providing compensation and tax information remember that you should only be providing numbers for the quarter that the filing covers for instance if you're filling out this form for the April 30th deadline you would only pr wage and withholding information for January February and March so...

PDF editing your way

Complete or edit your irs com anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export form 941 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your irs form 941 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your 941 form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form 941

About Form 941

Form 941 is a quarterly tax form used by employers in the United States to report their federal income tax withholdings, Social Security tax, and Medicare tax for their employees. It is primarily used to determine the employer's tax liability for the quarter and reconcile the total amount of taxes withheld from employee wages. Employers are required to file Form 941 if they have employees on their payroll and withhold taxes from their wages. This includes businesses, government agencies, nonprofit organizations, agricultural employers, household employers, and any other entity that pays wages to employees. Generally, if an employer has paid wages subject to income tax withholding, Social Security tax, or Medicare tax, they are obligated to file Form 941. Form 941 must be filed by the last day of the month following the end of each calendar quarter. For example, the quarter ending on March 31st would require filing by the end of April. Failure to file or filing incorrect information on Form 941 can lead to penalties and potential audits by the Internal Revenue Service (IRS).

What Is Irs Form 941?

Irs 941 Form is a payroll tax document. Usually employers use it to report withholding federal income, Medicare Social and Security taxes, as well as payments for all these withholding amounts. The document has to be prepared four times per year, following the end of the quarter.

For example for the first quarter of 2017, ending March, 31st, you have to submit the paper by April, 30th. For the second quarter, ending June, 30th, file the form by July, 31st. And so on.

In case, the due date falls on weekend day or holiday, the deadline is the next working day.

To be in time for all deadlines a person may use online blank forms. These means are critically important to streamline your business processes and avoid pointless paperwork hassles.

Find the appropriate template and prall the required details in fillable fields.

The Irs 941 Form includes quarterly calculations and reports pertaining to amounts:

- Withheld from employee paychecks for federal income and FICA taxes;

- Due: from taxable social security and Medicare wages from employees and employer;

- Due in payment by the hirer;

- Paid by hirer depending on the number of workers and size of wage.

Every employer has also to indicate adjustments for tips and sick pay and any over- and under- payment.

Complete the form accurately and check the provided data in order to avoid any errors. If necessary, print out the blank and fill it by hand.

Online options help you to arrange your document administration and supercharge the productiveness of one's workflow. Go along with the fast guidebook with the intention to total Form 941, stay away from errors and furnish it inside a well timed manner:

How to accomplish a Form 941 internet:

- On the website along with the form, click Start off Now and pass towards editor.

- Use the clues to fill out the relevant fields.

- Include your personal information and facts and call details.

- Make guaranteed that you enter correct material and figures in best suited fields.

- Carefully look at the subject material belonging to the sort too as grammar and spelling.

- Refer to support area for those who have any thoughts or handle our Help workforce.

- Put an digital signature in your Form 941 when using the aid of Indication Software.

- Once the shape is concluded, press Carried out.

- Distribute the ready kind by way of electronic mail or fax, print it out or conserve on your device.

PDF editor allows for you to definitely make alterations in your Form 941 from any net related product, personalize it as reported by your requirements, indication it electronically and distribute in different approaches.

What people say about us

E-filing templates at home - important ideas

Video instructions and help with filling out and completing Form 941