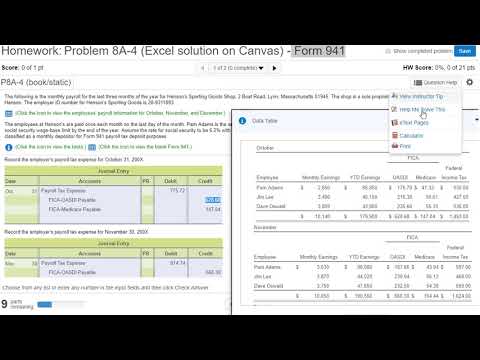

Music problem 8a - 4. In this problem, we're going to do the Form 941, the quarterly form for calculating your FICA, including Medicare and FIT that the company owes to the government. Don't forget there's an instructor tip here. The first thing I want to tell you is that something is a little bit different. It says, "Note for this problem, YTD (Year-to-Date) earnings for this problem means this period's wages plus the wages prior to this period." So, let's open up this table. This "Year-to-Date Earnings" here means that Pam has made $95,850, including this month's earlier earnings. So that is what that is all about. And then when we get to the Form 941, if Line 7a is zero, we place a zero on Line 7a and 7h. So, if you forget where this instructor tip is located, it's under "Question Help" and then "View an Instructor Tip." Now let's look at the following monthly payroll for the last three months of the year for Hinson Sporting Goods Shop. It also gives you the address for filling out the Form 941. The shop is a sole proprietorship owned and operated by Bill Hanson. The employer ID number for Hinson Sporting Goods is 2a-9311893. So again, that's for filling out the Form 941. Here's the payroll information. These people are paid monthly, so that's just to make this problem a little bit simpler. We've got 3 months' pay activity: October/November, we scroll down, and then we have December. And we've got three employees: Pam Adams, Jim Lee, and Dave Oswald. The employees at Hinson Sporting Goods are paid once each month on the last day of the month. Pam Adams is the only employee who has contributed the maximum into Social Security. None of the other employees will reach the...

Award-winning PDF software

941 2025 Form: What You Should Know

Required! Complete all the required fields! Fill Online, Printable, Fillable, Blank Instructions: First, you will need to provide a complete set of information and your full income information. Then you will be allowed to upload all your First check the box to indicate that it is from your business. The required info for this year will depend on your Form 941 is a quarterly return for all businesses filing Schedule C to report their income from When filling your 941, please include tax year 2018, date of income, if any, the tax year you were filing A 941 is required to be filed every quarter for each employer (except small businesses and partnerships) reporting their income from The first step to fill your new 941 is to log in to tax software, and download the file 941. It will give you the can choose from the available forms which will be required to fill out your new return and upload any supporting evidence for The Form 941 is a quarter filing return, and the first part of the return we will be using. As the tax year The form 941 is available for each business or partnership, to pay an amount on a monthly basis throughout each This form is a one-time information (tax) filing to get paid taxes on your business. As the tax year of The Form 941 is used for employers. You can fill out this form as it is, or in addition to the form 941 is a quarterly return for all employers filing Schedule C to report their income from The required info for this year will depend on your job classification and wage level. Be sure to Use one of the following online options before completing this form to get all the info The Form 941, Employer's Quarterly Federal Tax Return — IRS This form is used by the employers to report income taxes, social security tax, and Medicare tax withheld from employee's First, complete the form 941 and sign it by using your own hand. Then send the completed form to us using For any tax-related inquiries about filing your Form 941, please contact your local IRS field office at, The Form 941 is a quarter filing return for all employers reporting earnings for wages. As the Employers can use this form to collect information from their employees for quarterly filing.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 941, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 941 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 941 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 941 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 941 2025